Increased emphasis on agility in finance and sales operations is often seen strictly through the prism of increased speed metrics such as time to market and time to revenue. However, equally important in this context is the ability to rapidly create new capabilities from existing functions of finance automation solutions. This requires that organizations unpack the capabilities contained in the traditional “functional boxes.” In this research report, we discuss how generating new capabilities from the components of existing solutions can help organizations achieve proactive revenue management capability with a direct and immediate impact on both topline growth and bottom line profitability. Specifically, we highlight the concepts of proactive revenue management and revenue and margin radar.

KEY ISSUES

How will advances in microservices impact innovation in finance automation?

What are the new, disruptive product capabilities that can help finance improve strategic outcomes?

BOTTOM LINE

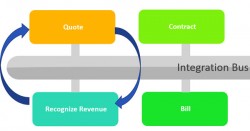

In order to create real competitive differentiation with monetization, organizations will need to think in terms of combining atomic functions of individual services from a variety of products into new, often proactive capabilities to simulate and predict revenue and profitability before a proposal is submitted and order accepted. Revenue Radar and Margin Radar are two conceptual capabilities that leverage elements of CPQ, Agile Billing, Automated Revenue Management, and Financials.