Overview

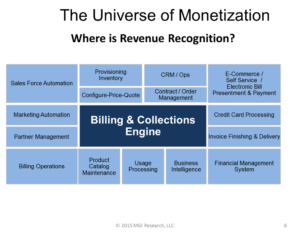

While finance automation can be a broad category, it is typically driven by the need to streamline revenue operations. Most companies that examine their current automation capabilities in this area quickly realize that the incumbent toolset is hardly adequate. The explosive growth of new pricing models (single product to recurring services, hybrid models, product and services bundling, and growing use of third-party partners/solutions) created the need for complex, multi-party settlements and sophisticated, automated, and repeatable revenue recognition capabilities that far surpass individuals using Excel or the out-of-the-box functionality provided by traditional financial accounting packages. 95% of the accounting packages in use today were designed and built prior to the rapid rise of ‘As-a-Service” business models or the sophisticated professional services and product solutions that are increasingly common today. This gap in automated capability forces many organizations to look at new, specialized options for automating revenue recognition.

As revenue recognition solutions increase their capabilities and offer more predictive, prescriptive analytics, sales operations and financial planners will be drawn into using the data and functionality of rev rec solutions connected to other elements of an Agile Monetization Platform (AMP) like incentive compensation, contract management, and billing to better look at finance automation on the whole.

MoreOur Finance Automation research is designed to help clients navigate the new and emerging revenue recognition best practices, technology solutions, and interactions between rev rec and other agile monetization processes and solutions. We seek to identify best-in-class companies, best practices, and important metrics and benchmarks. MGI publishes reports such as MGI 360 Ratings and Forecasts that help executives navigate the evolving finance automation and revenue recognition landscape.

Featured Research

Workday in Automated Revenue Management (ARM)

We are raising Workday’s MGI 360 rating in Automated Revenue Management (ARM) to 65 and maintain a POSITIVE Analyst Outlook.

Zuora in Automated Revenue Management (ARM)

Zuora’s MGI 360 Rating in Automated Revenue Management (ARM) improves to 62, retaining a POSITIVE Analyst Outlook.

Key Issues

MGI’s Finance Automation research provides business and finance executives with an unmatched combination of user insights, market data, vendor analysis, and confidential advisory services on revenue operations including automated revenue recognition solutions. Backed by the MGI 360 Ratings and MGI Market Forecasts, we are the only firm to issue independent, quantitative ratings of automated revenue recognition providers and sizing of the market. Below are examples of key issues we address for our clients.

- How will companies automate core business processes in revenue operations?

- How are best-in-class companies digitizing new recurring revenue business models?

- What is automated revenue recognition, and what are automated revenue recognition best practices?

- What are the critical automated revenue recognition capabilities, and how will finance automation evolve?

- How can other departments benefit from automated revenue recognition and additional finance automation?

- How do automated revenue recognition solutions compare in terms of cost, implementation times, and benefits delivered?

- What is the realistic size and total addressable market (TAM) for automated revenue recognition solutions?

- What are the critical and emerging requirements for modern automated revenue recognition solutions and their integration with other agile monetization solutions?

- What key factors will shape the supplier landscape in agile monetization technology?

- What factors will drive adoption of automated revenue recognition solutions?

- How will incumbent suppliers meet the emerging requirements for automated revenue recognition?

- Which companies are likely new market entrants or disruptors?

Capabilities

MGI Research coverage enables IT executives, users, and investors to make more informed, timely, and critical go/no-go decisions on issues that directly affect valuations, market entry and exit, major investments, acquisitions, and divestitures. MGI’s core quantitative research helps technology vendors and investors to more accurately assess and benchmark company operating performance and strategy as well as identify paths for improvement in growth, gains in market share, and valuation multiples.

MGI’s research process is based not only on the experience and opinions of key analysts but also on in-depth and continuous information gathering, validation, peer review, and analysis as well as an extensive database of operating metrics. Being an independent research firm empowers MGI to voice unbiased opinions and make nonlinear predictions.

View All Research-based PracticesFinance Automation Vendors Under Coverage (Partial List)

The market for targeted third-party solutions is comprised of niche automated revenue management (ARM) vendors, monetization vendors who offer rev rec as part of a broader set of Agile Monetization Platform capabilities, and stand-alone financials vendors with ARM capabilities. The finance automation landscape is continuously evolving and thus challenging to navigate when critical decisions that impact the future performance of the business need to be made.

MGI Events

Rev Rec 360 Ratings Reveal

This webinar will reveal key takeaways from MGI Research’s Revenue Recognition Top 25 Buyer’s Guide, including who the top-rated suppliers are in Rev Rec and why they stand out from the rest of the pack.

Accelerating Vendor Evaluations: Getting the Right Fit, Faster and With Less Risk

In this webinar we share experiences from hundreds of product valuations. Whether it’s a new CPQ, CLM, billing, revenue recognition, or payments solution you are looking for, this is sure to save time and money—and help improve the vendor evaluation process.

Finance Automation Catalyst Subscription Access

By accessing the power of MGI Research resources, clients get a comprehensive view of the market that includes enterprise best practices, quantitative research, and analysis of all the billing and business applications vendors as well as the collective experience of the MGI analyst team that brings decades of enterprise experience. Our research is updated continuously, and clients have unlimited, direct access to our analyst team.

Learn More