The risks – and rewards – of buying an automated revenue management (ARM) solution are high. Make the right choice and ROI targets are achieved, finance scales efficiently . . . and no one notices. Get it wrong, and the CFO goes to jail.

The Automated Revenue Management Top 27 Buyer’s Guide aims to help CFOs, finance, and IT teams understand the benefits of modern ARM (aka “revenue recognition”) solutions and make better, timelier, and more informed finance automation strategy and purchasing decisions – while mitigating the risks of getting it wrong.

This Buyer’s Guide highlights current and future ARM market dynamics and provides analysis and ratings of the most consequential vendors in this space. This report also includes four MGI MarketLens™ charts: a set of proprietary lenses highlighting how solutions compare in terms of their agility, ability to handle revenue and business complexity, and support for volume, go-to-market strength, and solution strength. The MGI MarketLens helps buyers understand the relative strengths and weaknesses of solutions and gives vendors a tool for benchmarking their performance in these key areas.

Automated Revenue Management Vendors Under Coverage

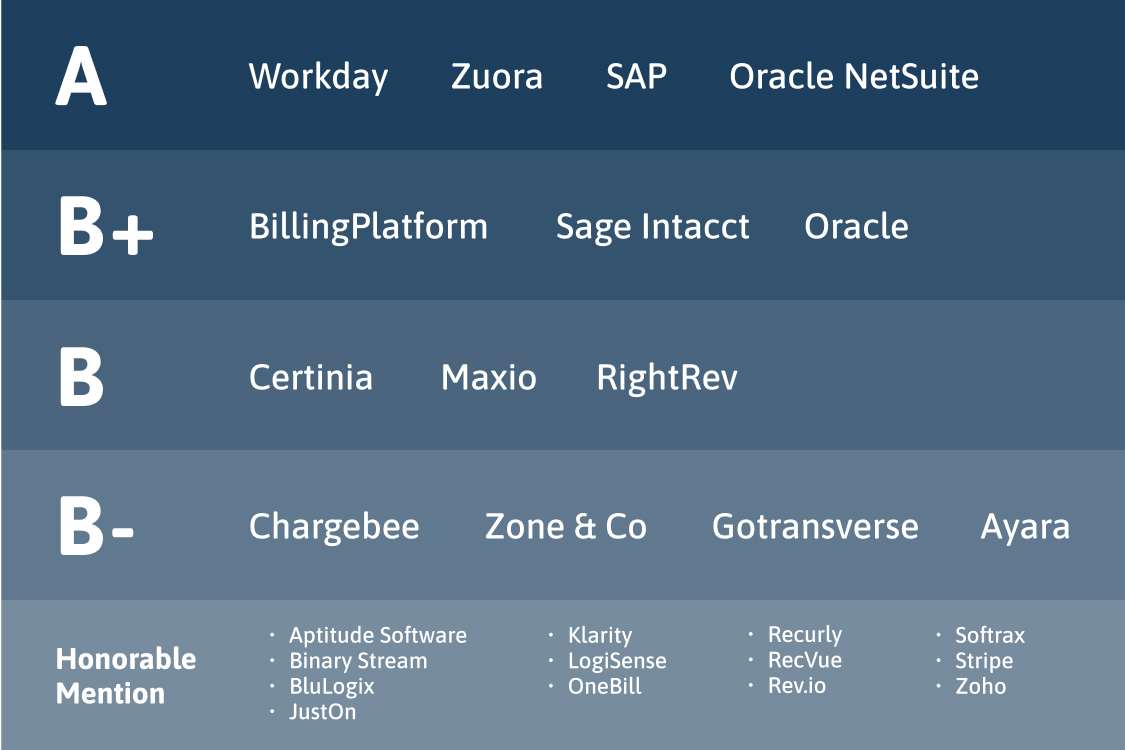

The ARM Top 27 Buyer’s Guide provides ratings and analysis on 14 suppliers of automated revenue management solutions, as well as coverage of 13 honorable mention suppliers. According to MGI Research, these are the most significant solutions and suppliers in the market today. Only the top vendors are included in this report. It includes full MGI 360 Ratings™ using a rigorous quantitative rating (scored 0-100), a letter grade based on quartile rating results, and a qualitative Analyst Outlook (Positive, Neutral, Negative) on 14 vendors, as well as Honorable Mention summary analysis on 13 additional companies.

Vendors receiving full 360 Ratings and letter grades are: Ayara, BillingPlatform, Certinia, Chargebee, Gotransverse, Maxio, Oracle, Oracle NetSuite, RightRev, Sage Intacct, SAP, Workday, Zone & Co., and Zuora.

The 13 suppliers receiving Honorable Mention, but not rated for this report, are: Aptitude Software, Binary Stream, BluLogix, JustOn, Klarity, LogiSense, OneBill, Recurly, RecVue, Rev.io, Softrax, Stripe, and Zoho. MGI Research tracks approximately 15 more vendors in this space and reserves the right to publish ratings and analyses on select vendors as deemed worthy and appropriate.

What is Automated Revenue Management (ARM)?

Once viewed as an adjunct to the general ledger of an accounting application and considered a tool for managing revenue recognition schedules and compliance, automated revenue management (ARM) is now seen as a must-have component of the modern finance organization. Many companies were first motivated to investigate revenue recognition applications to enable compliance with the adoption of ASC 606 and IFRS 15 in 2018/19. Today, demand drivers for ARM expanded beyond the need for compliance into granular revenue management at a sub-ledger level with capabilities for analysis, reporting, and forecasting; a tool that finance and other teams can use not just at period-end, but daily. This report is the result of months of in-depth research that included hundreds of conversations with customers, accounting and audit partners, systems integrators, ARM vendors, and institutional investors.

ARM software solutions help automate accurate and timely classification, scheduling, allocation, calculation, and presentation of revenue in the appropriate periods and amounts within accordance of national and global accounting standards and other regulatory mandates. ARM is a key element of an agile monetization platform.

Since the publication of the last ARM Buyer’s Guide in 2022, the market for ARM solutions has blossomed – with standalone, billing-attached, and integrated financials suite vendors all bringing out new capabilities. Business models have evolved, with more attention on usage and consumption pricing models driving demand for faster, more agile revenue automation tooling. Buyers and sellers alike are becoming better educated, sophisticated, and mature. Market leaders are characterized by their novel approaches to not only supporting one-time and recurring revenue pricing models, but by their abilities to manage a diverse range of business models. And buyers are bringing more experience and higher expectations to the market.

The market is beginning to realize that ARM products are responsible for much more than automating accounting at the end of the month or quarter – they give finance leaders the ability to influence operational decisions in real-time as business is transacted. For the most progressive CFOs and CAOs, ARM solutions are viewed as a proactive intelligence tool that enables decision-making during the financial quarter. While some investment in ARM solutions is driven by migration from legacy systems to cloud-based tools, the bulk of the spend is net new spend for companies of all sizes as the ROI and business benefits justify significant investment in the category.

Automated Revenue Management Top 27 – Why These Companies?

This report focuses on the top 27 vendors in ARM and provides comprehensive MGI 360 Ratings on the top 14. In our view, today, these vendors, are among the most consequential ARM suppliers in the market and merit the attention of buyers, partners, and investors. The MGI 360 Rating methodology is quantitative in nature with a tough, nonlinear grading scale. Any vendor among the 14 rated suppliers is in our view important and impactful, regardless of the absolute score. The criteria for inclusion include one or more of the following:

- Market visibility: The company has one or more of these characteristics: above-average growth, often included in longlists and shortlists of buyer evaluations, large installed base, and/or most MGI clients express interest in the company or mention them in analyst calls.

- Innovation: The product has unique capabilities and the potential to disrupt the market – buyers should be aware of this product/company, even if it is not a fit for them today.

- Solution strength: Breadth and depth of solution, support for various business models and use cases, and the supplier’s ability to help customers implement and gain value from the solution.

- Demonstrated success: Most, but not all, vendors covered are able to provide MGI with reference customers and partners to interview. Independent of the provision (or lack thereof) of vendor references, MGI conducts its own interviews and field research on customers, partners, and investors.

About MGI 360 Ratings™

MGI 360 Ratings™ are a comprehensive structured system for evaluating technology companies. The MGI 360 scores reflect analyst opinions based on a scale of 0 to 100, combined with an analyst outlook (Positive, Negative, or Neutral), across five key pillar scores:

- PRODUCT: How strong is the product’s competitive position?

- MANAGEMENT: How competent and experienced is the management team?

- CHANNELS: Does the company have a sales capability and channels needed to bring products to market?

- STRATEGY: Does the company have a realistic view of the opportunity and a compelling strategy for success?

- FINANCE: Is the company growing and profitable?

Each pillar score is subdivided into numerous sub-categories – in total, over 149 criteria are combined to generate a single MGI 360 rating. We frequently emphasize that the MGI 360 scale is very demanding and companies need to be exceptional in every aspect of their business to command higher scores.

MGI Research assigns a letter grade of A, B+, B, or B- to all 360 Rated suppliers. Letter grades are assigned by dividing the 14 overall 360 Rating scores into four quartiles. The top-performing quartile receives an A grade, the second-highest rated quartile receives a B+, the third quartile receives a B, and the lowest-rated quartile of ARM suppliers receive a B-.

SPEAK TO AN ANALYST: Organizations looking for additional support in crafting an evaluation strategy and conducting an independent assessment of potential suppliers should contact MGI Research here.