Summary: Updating the MGI 360 Rating of Salesforce in the Agile Billing market to a score of 53 and a NEUTRAL analyst outlook. Salesforce Billing is part of the Salesforce Revenue Cloud suite and was originally introduced to capitalize on the broad success of the Salesforce CPQ offering (Steelbrick CPQ). Salesforce CPQ and Salesforce CRM are currently two of the most widely used CPQ and CRM solutions on the market with millions of users globally. Salesforce CPQ customers often view the billing product as an addendum to CPQ – once their quotes are generated, Salesforce Billing can generate invoices, and more. Adoption of Billing, however, has lagged CPQ significantly, ostensibly because it is an immature product effort with mixed customer reference feedback. For smaller businesses and non-profits (<$100 million in revenue) – Billing fits the classic Salesforce success formula of the product targeting the needs of most users and it often meets/exceeds small client requirements. Customers tend to bemoan the overall cost and ongoing TCO. Larger and more sophisticated businesses find the product too simplistic and lacking depth and adequate performance. After considerable implementation efforts, some customers end up seeking 3rd party options. Customer feedback on Salesforce Billing covers a broad spectrum ranging from enthusiastic to those unwilling to recommend it. Numerous competitors have peeled away customers that, in theory, Salesforce Billing should have satisfied. These include Stripe, Chargebee, Zuora, and Maxio at the low-end of the market where Salesforce Billing ends up being viewed as an expensive option with limited agility. Larger organizations with enterprise use cases end up demanding support for more volume, complexity, and agility. Salesforce stands out for its best-in-class partner ecosystem and sizeable channel (Channels score: 14.11). Salesforce partnerships in the Revenue Cloud ecosystem overall – particularly around adjacent/complementary products for AMP – have produced inconsistent results and caused many partners to pull back. With focus, this could be easily addressed. A strong, unequivocal commitment to the product as an equal among the Salesforce “clouds” is missing today, but with dedicated resources, there may still be an opportunity for Salesforce Billing to match the success of its CPQ product.

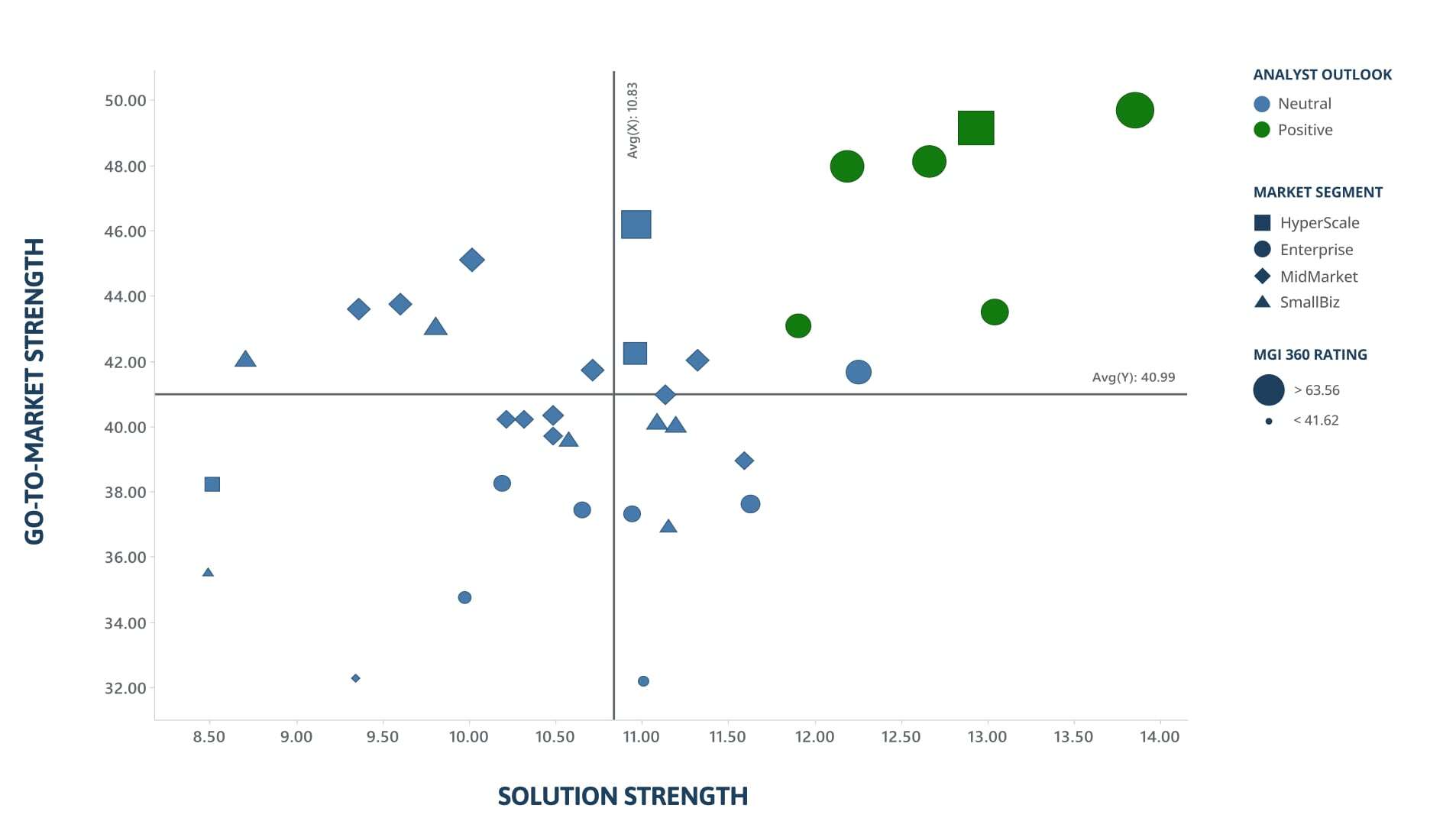

Get the report to find out where the Agile Billing Top 50 fall on the chart below.

Competitors: Chargebee, Maxio, Oracle NetSuite, Stax Bill, Zuora