Welcome to The Margin, a newsletter designed to keep you on the leading edge of monetization.

In business, the difference between being ahead of the curve or slow to adapt is anything but marginal. The Margin aims to be the most useful, timely, and incisive ping that hits your inbox all week. It includes critical research and analyst insights to inform short and long-term decision making.

Here’s what you need to know:

Research spotlight | Where is services management growing?

The Service Economy continues to expand at rates far exceeding average GDP growth, increasing its relative share of the global economy. Its continued expansion is driven by the rapid growth of services businesses vs. traditional product-only solutions, the introduction of an ever-growing array of new services offerings, and conversion of existing product-first businesses to the as-a-Service approach.

MGI Research recently assembled bottom-up TAM forecasts for three markets comprising the services management space: Service-as-a-Business (SaaB), Professional Services Automation (PSA), and Finance Automation for Services Organizations (FASO).

- Service-as-a-Business (SaaB) is a reference model that brings together key capabilities for running any services business efficiently and effectively. We project the SaaB TAM will grow at a CAGR of 20.6% over the next five years.

- Professional Services Automation (PSA), as a subset of the broader Service Economy, specifically focuses on the people involved in automated services delivery. It benefits from the growing structural shortage of skilled professional labor and the concentration of critical and complex skills within specialized global service providers. We project the PSA TAM will grow at a CAGR of 21.7% over the next five years.

- Finance Automation for Services Organizations (FASO) describes the key functional components needed to automate the core financial elements of services management. We project the FASO TAM will grow at a CAGR of 18.1% over the next five years.

A Story You Can’t Afford to Miss | PROS Outperform Conference 2023

- CPQ and airline industry specialist PROS hosted its largest user conference ever last week.

- Generative AI sessions are jumping the shark – PROS added a positive twist.

- The airline industry is undergoing a major shift in its approach to pricing/revenue models.

- PROS aims to be the value CPQ provider – with a broad Q2C or AMP vision yet to come.

On the horizon | 360 Ratings™ in Agile Billing

- Mark your calendar – the new batch of 360 Ratings in Agile Billing will be published on June 28.

In the meantime, please take 10 minutes to complete our survey on the State of Billing.

Now let’s dive a bit deeper.

Research Spotlight

Where Is Services Management Growing?

MGI Research recently assembled bottom-up TAM forecasts for three markets comprising the services management space: Service-as-a-Business (SaaB), Professional Services Automation (PSA), and Finance Automation for Services Organizations (FASO).

The Service-as-a-Business (SaaB) report aggregates the total projected spend for 14 services management markets over the next five years, filtereddown to only include spending that can be attributed to services-related revenues:

- Project Management, General Ledger, Skills Management, Automated Revenue Management, Time Management, Agile Billing, Resource Management, CPQ, Expense Management, FP&A, Order Management, Customer Success, Procurement Management, and Inventory Management.

These are the key functional components needed to manage automation of service delivery as well as the basic financial management elements to maintain an economic relationship with clients.

- This is not a complete list but represents the basic minimal set of capabilities needed to manage a services organization.

- The total, five-year SaaB spend (2022-2026) is projected to reach $283.40 billion.

The Professional Services Automation (PSA) report aggregates the total projected spend for eight professional services markets over the next five years, filtered down to only include spending that can be attributed to services-related revenues:

- Project Management, Skills Management, Automated Revenue Management, Time Management, Agile Billing, Resource Management, CPQ, and Expense Management.

While the SaaB framework addresses the broader use cases of digitally transforming services businesses, PSA is the main avenue for improving the productivity, efficiency, and precision of running a services organization.

- The total, five-year PSA spend (2022-2026) is projected to reach $173.55 billion.

The Finance Automation for Services Organizations (FASO) report aggregates the total projected spend for eight financial services markets over the next five years, filtered down to only include spending that can be attributed to services-related revenues:

- General Ledger, Automated Revenue Management, Agile Billing, Expense Management, FP&A, Order Management, Procurement Management, and Inventory Management.

These are the key functional components needed to automate the core financial elements of services management.

- The total, five-year FASO spend (2022-2026) is projected to reach $192.33 billion.

A Story You Can't Afford to Miss

PROS Outperform Conference 2023

600 PROS customers and partners gathered in Denver last week to swap CPQ and price optimization stories and learn from PROS. Like at every other user conference, AI/ML, and generative AI in particular, were on the agenda. This will be the case at every industry event this year. After a standard intro to ChatGPT, PROS walked through a handful of use cases – good, bad, and so-so – for generative AI. Attendees found the discussion enlightening and useful.

PROS pioneered the revenue management and dynamic pricing software application space and today it serves nearly every airline in the world. The high concentration of transportation industry attendees can make Outperform feel like an airline industry event.

- Due to the long-standing connections between airline pricing execs and Operations Research (OR) academics, there is a willingness to share amongst attendees.

- This conference is exceptional for the depth of customer case studies presented.

- A few major airline trends are: a) shift to dynamic pricing, b) embrace of “willingness to pay” science, and c) ancillary revenue streams.

In CPQ (MGI 360 Rated: 53, Neutral Outlook), there were several announcements. The ICP for the CPQ product centers around a $100Mil to $1Bil revenue, midsize, physical goods manufacturing customer seeking a CRM-agnostic solution that emphasizes the “C” in CPQ. PROS aims at the value-oriented buyer. Although it has unique strengths overall, PROS has yet to unveil a comprehensive strategy for enabling end-to-end monetization (e.g., a vision for AMP or even an integrated quote-to-cash story). With a CMO now in place for a year, this vision may yet materialize.

Under the Hood | Attention in the business community will move very quickly from “what is AI/ML and generative AI?” to seeking concrete examples of use cases and risk/benefit analysis. Progressive user organizations we met with are seeing triple digit ROI in early POCs.

The airline industry historically has been in the vanguard of pricing innovations (customer sentiment towards carriers is a separate issue). Pricing leaders outside of transportation would be well-served to pay close attention to the methods and approaches being rolled out by airlines today.

PROS has multiple tailwinds:

- Inflation and continued supply chain disruptions are driving companies to adjust prices dynamically and manage margins carefully;

- AI is at the top of every CEO and CIO priority list;

- The airline business is flying high; and

- Other CPQ vendors are in flux.

Each of these alone would be enough to propel a CPQ/pricing vendor to outperform the industry average growth rate. While PROS recently increased financial guidance, the company’s projections are surprisingly modest in comparison to its opportunity.

The bottom line | As a leader in airline and commodities industry price optimization, PROS is uniquely positioned to bring revenue optimization models to a wide swath of B2B industries.

- To date, the synergies between its airline-focused pricing solutions and the CPQ solution have been limited.

- The company is betting on its re-vamped, cloud-native product architecture, the promise of delivering faster time to value, and buyer demand for AI to propel growth.

On the Horizon

We’re putting the finishing touches on our new batch of 360 Ratings in Agile Billing, which will include quantitative and qualitative vendor evaluations of 35 leading billing providers. It also includes analysis of 16 Honorable Mention vendors who did not receive a 360 Rating.

We plan to publish all 35 new 360 Ratings on June 28. This round of ratings highlights new entrants, analyzes the future of wounded mega-vendors, and de-constructs the hype around usage and consumption billing models.

The comprehensive Agile Billing Buyer’s Guide & Market Ratings Report is slated for publication later this summer.

How it works | MGI 360 Ratings are comprehensive vendor evaluations that assess tech vendors on their abilities to bring value and innovation to customers. These quantitative ratings score suppliers in five key dimensions (Product, Management, Strategy, Channel, and Finance) on a scale of 1-100.

Who should be excited | Buyers, sellers, and investors seeking to understand the billing market’s leaders and laggards – and the distinct capabilities that define them.

Stay tuned for 360 Ratings covering (partial list):

- LogiSense

- Salesforce

- Evergent

- Certinia (formerly FinancialForce)

- BillingPlatform

- Chargebee

- Gotransverse

- Stripe

- and more.

In the meantime, revisit our most recent 360 Ratings:

- Icertis in Contract Lifecycle Management (CLM)

- Good Sign Solutions in Agile Billing

So What Have I Missed?

The Topical 20 | Our most recent and relevant research that will help you keep your finger on the pulse of AMP disciplines.

1. Going Global With E-Commerce

2. Tech Trends: Mapping the Software Industry

3. Configure-Price-Quote (CPQ) TAM Forecast 2022–2026

4. The Future of CLM Is Data-1st

5. Declouding: Will Curiosity Inspire Action?

7. Q2C Success: What Does It Take To Achieve Excellence?

8. 2024 Tech Budgets Preview — Webinar

9. Here Comes Usage! Adopting & Optimizing Consumption Business Models — Webinar

10. The Agile Billing Top 50 Webinar

11. The Agile Billing Top 50: A Buyer’s Guide

12. MGI Forecasts: Service-as-a-Business (SaaB) Software Global TAM Forecast 2022–2026

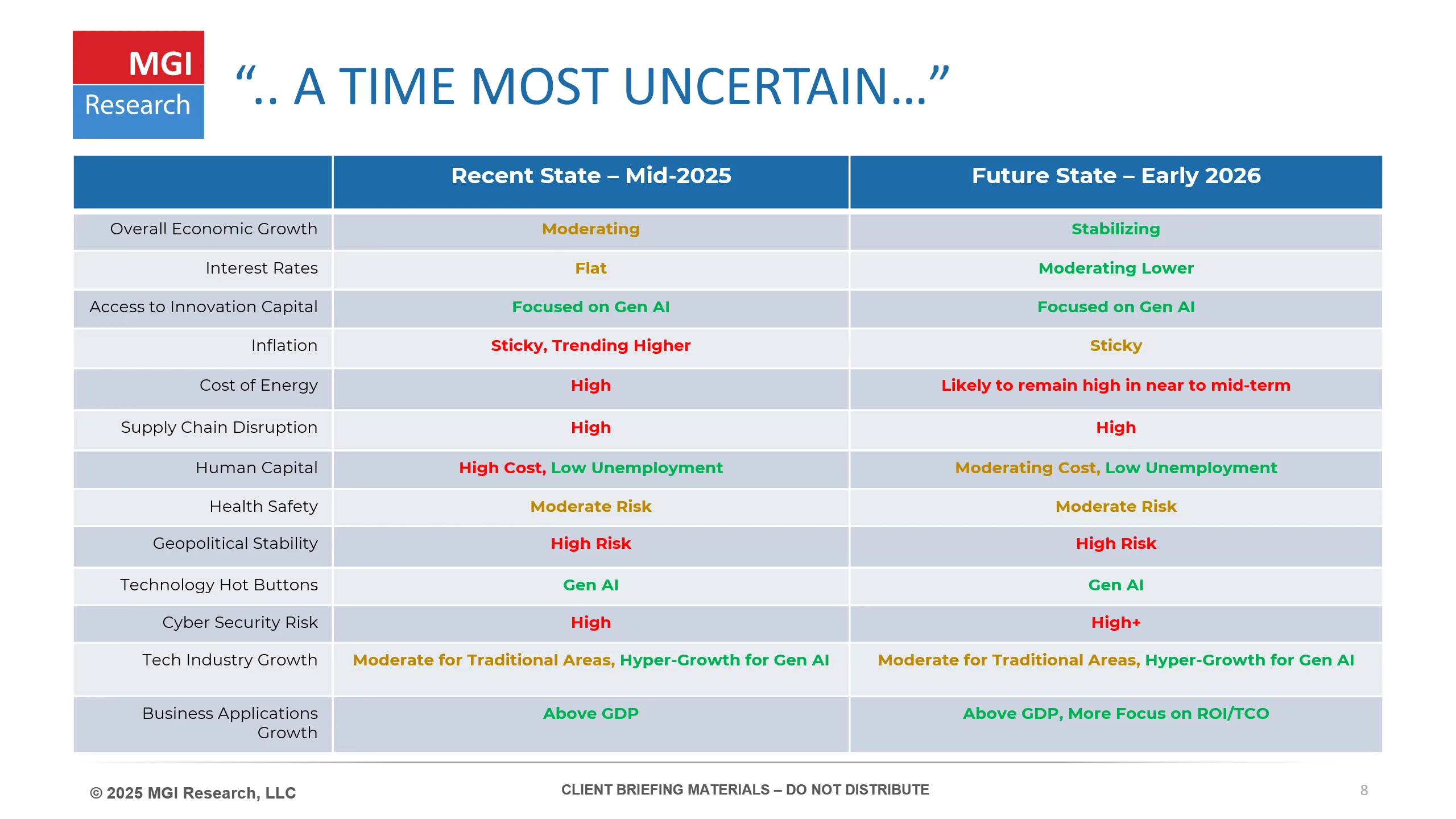

14. Survival of the Fittest: Managing Extreme Economic Uncertainty

15. The Global Tech Market Is Bigger Than You Think

16. Is Software Still Eating the World?

17. Not a Typical Recession: Making Sense of the Global Economy

18. Use Case Note™: Opencell in Agile Billing

19. 360 Rating™: Icertis in CLM

20. The 13 Deadly Sins of Agile Monetization

and 32 other Use Case Notes!

The Evergreen Archives | Curated past research that is still pertinent today.

1. Quote-to-Cash Is Dead; Long Live Prospect-to-Disclosure

2. What Every CEO Needs to Know About Subscription Business

3. Evolution of MoR into Monetization as a Service

4. Mediation 2.0: Taking on the Data Challenge in Agile Billing

6. Headless eCommerce Architecture: Is eCommerce Losing Its Head?

That’s all for this issue of The Margin. If you’ve made it this far, we’ll certainly see you next time.

Warm Wishes, MGI Research